European Framework

In the wake of the global financial crisis that began in 2007 and the reform process that followed, the European financial supervisory model has undergone a profound transformation.

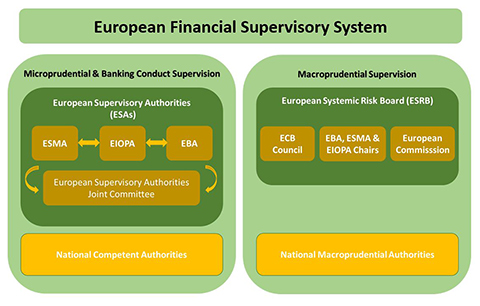

The European System of Financial Supervision (ESFS) is currently composed of the Financial Supervisory Authorities (ESMA, EIOPA and EBA), the national supervisory authorities and the European Systemic Risk Board (ESRB).

Established in 2011, the European Supervisory Authorities (ESAs) are EU bodies with legal personality, whose powers and competences include contributing to the development of harmonised and coherent rules (Single Rulebook) and their uniform application in the EU through a common supervisory culture. Among these entities, there is a distinction in sectoral activity: the European Banking Authority (EBA) acts in the banking sector, the European Securities and Markets Authority (ESMA) in the field of financial instruments markets and the European Insurance and Occupational Pensions Authority (EIOPA) in the insurance and occupational pensions sector.

As part of the process of reforming the European supervisory model, the European Systemic Risk Board (ESRB), which is responsible for EU macroprudential supervision across the various sectors of the financial system, and for preventing and mitigating systemic risk, was also set up. The ESRB has as its counterparts, in the Member States, the national macroprudential authorities responsible for the conduct of macroprudential policy domestically.

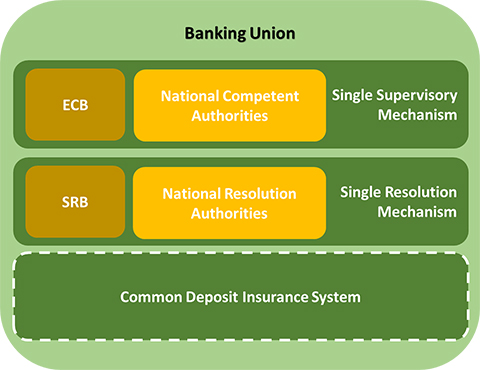

In 2014, the creation of the Banking Union introduced further significant changes to the supervisory model at the EU level with a view to establishing an integrated financial framework that would contribute to financial stability in the euro area. In this context, it was decided to create a three-pillar model: a Single Supervisory Mechanism, a Single Resolution Mechanism and a Common Deposit Guarantee Scheme, the last still to be implemented.

The Single Supervisory Mechanism (SSM) is intended to ensure supranational consistency in the prudential supervision of institutions. The SSM consists of the European Central Bank (ECB) and the competent national authorities of the nineteen Member States that form the Euro Area. In the context of the SSM, the ECB is ultimately responsible for the prudential supervision of all credit institutions and is responsible for the direct supervision of so-called significant institutions. The supervision of credit institutions that are classified as less significant is the direct responsibility of national supervisory authorities within a common framework defined within the SSM. The ECB may, under certain conditions, directly supervise such institutions.

The second pillar of the Banking Union, the Single Resolution Mechanism (SRM), establishes an integrated institutional framework for the resolution of credit institutions. The SRM is based on the existence of a single resolution authority, the Single Resolution Board (SRB), and a common mechanism for financing resolution measures, the Single Resolution Fund (SRF), which is funded by periodic contributions from participating institutions.