Multimedia

Discover APB audiovisual content with an educational component about banking services.

8th Dec, 2025

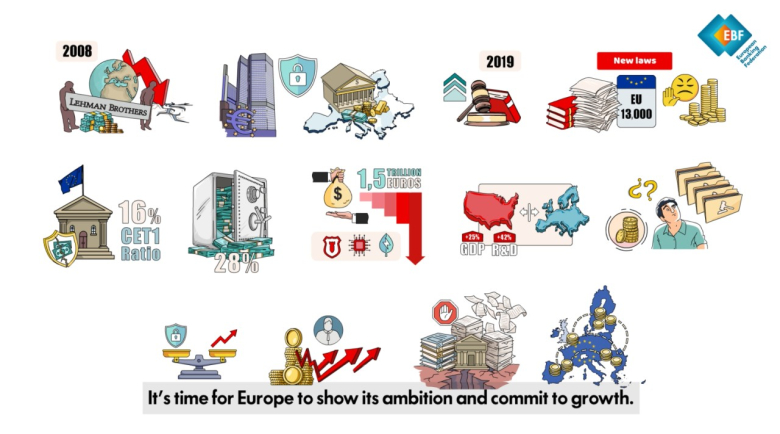

Simplify to compete: the EBF’s warning about excessive regulation

The excessive complexity of the regulatory and supervisory framework in the European Union is penalising the competitiveness of the banking sector and limiting its ability to finance the economy.

The problem is not the level of stringency of the rules, but their overlap, fragmentation and lack of consistency, which increase costs, create uncertainty and hinder the integration of the European market. The warning is contained in the Simply Competitive report by the European Banking Federation, of which the APB is a member.

The EBF stresses that simplification does not mean deregulation. On the contrary, it proposes intelligent simplification based on proportionality, clarity and harmonisation of rules, while safeguarding financial stability and protecting depositors. A simpler and more predictable framework would enable banks to support households, businesses and major European transitions, such as climate and digital, more effectively.

The report also points to the need to streamline regulatory and prudential processes, improve the consistency of supervision, reduce redundancies in digital legislation and align sustainability requirements, avoiding duplication. In short, regulatory simplification is presented as a key factor in strengthening the competitiveness of European banking and its contribution to the economic growth of the European Union.