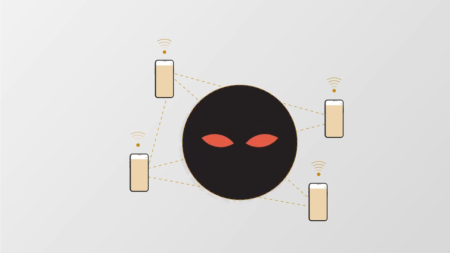

The Portuguese Banking Association (APB) launched a national awareness campaign, alerting citizens to the main risks of payment fraud .

In the first half of 2025, the Portuguese banking sector continued on a solid growth path, both in lending and in deposit activity. Solvency and liquidity ratios also remained at historically elevated levels.

What's New

APB participates in World Investor Week 2025

The Portuguese Banking Association (APB) is once again joining forces with World Investor Week (WIW), a global initiative promoted by the International Organisation of Securities Commissions (IOSCO), which runs from 6 to 10 October.

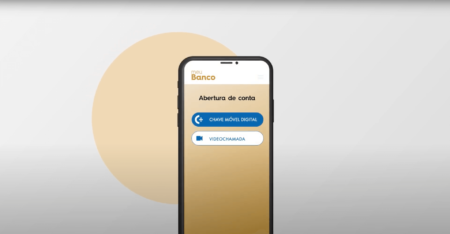

APB launches national awareness campaign against payment fraud

Today, 22 September, the Portuguese Banking Association (APB) is launching a national awareness campaign against payment fraud, with coverage on television, radio, in the press and on digital media, including social networks.

Issue No. 135 of InforBanca Now Available

A new edition of InforBanca magazine has just been published online

European Money Quiz brought together students from 30 countries to improve their financial skills

The Italian team won the European Money Quiz, Europe's largest financial literacy competition for 13- to 15-year-olds, organized by the European Banking Federation (EBF).

No Banco da Minha Escola: Second edition of APB's financial literacy initiative reaches 90 schools this year

The second edition of the “No Banco da Minha Escola” initiative, promoted by the Portuguese Banking Association (APB), began this month with participation from 90 schools...

APB celebrates 40 years with a conference on its role in the country’s development

The Portuguese Banking Association (APB) celebrated its 40th anniversary on October 17th by hosting a conference on the banking sector’s contribution to Portugal’s social and economic development over...

40 Years of APB: The Role of Banking in Socioeconomic Development

This year, the Portuguese Banking Association (APB) celebrates 40 years of activity. Over these four decades, the sector has faced many challenges, cementing its essential and irreplaceable role in society. To mark this milestone, the...

APB organizes Banking Open Day for around 150 high school students

The Portuguese Banking Association (APB) marked World Investor Week by hosting a Banking Open Day, featuring two financial literacy initiatives for young people: a session on online security and a visit to the “AI Innovation...

Approximately 4,000 students from 42 schools nationwide participated in APB’s financial literacy sessions

About 4,000 students from grades 7 through 12 participated in 189 financial literacy sessions conducted under the initiative “No Banco da Minha Escola,” organized by the Portuguese...

Austrian students win the final of the largest European financial literacy competition

The Portuguese Banking Association (APB) participated for the 7th time in the final of the largest European financial literacy competition, held on April 19 in Brussels.

Banking Sector

at a Glance

Get an overview of the main indicators of the Portuguese banking sector regarding its performance and its importance in supporting the economy, particularly in terms of size, credit, deposits, interest rates, liquidity, profitability, solvency and asset quality.

Topics

Get a comprehensive overview of the key areas that shape the banking sector, such as supervision, regulation, financial markets, and payments, among other key issues for the development of the financial system.

Multimedia

Members

The 27 members constitute more than 90% of the assets of the Portuguese banking system.