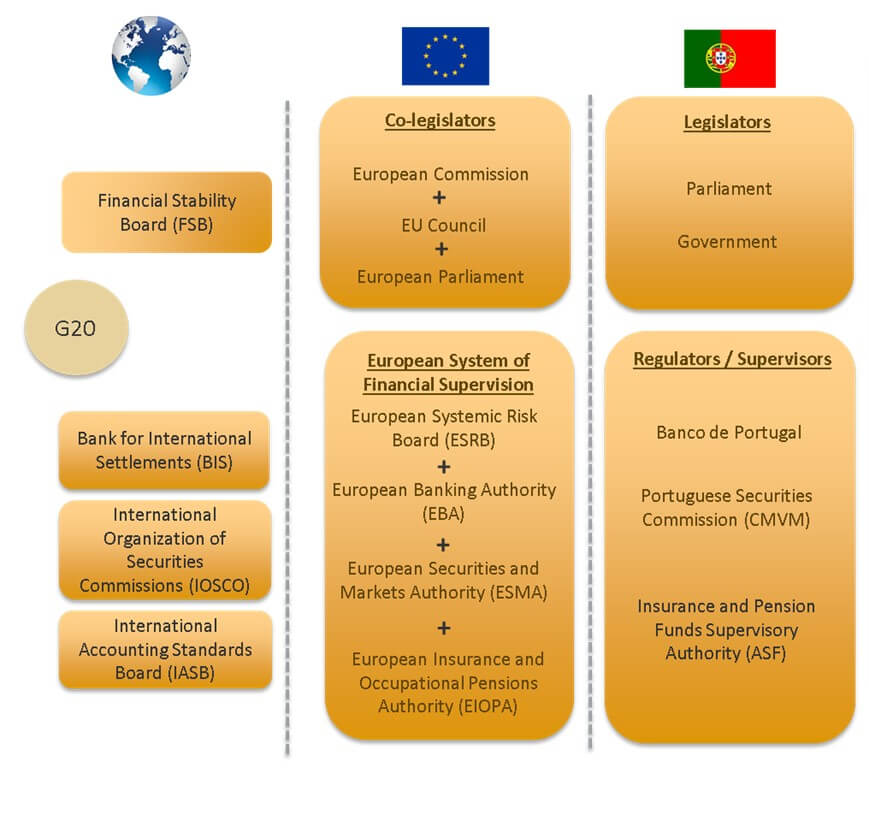

Regulatory and Supervisory Authorities

Several authorities and institutions intervene in the banking sector's legislative and regulatory framework.

International: The reference framework of rules that apply to the banking sector consists of the regulatory initiatives taken by a number of international bodies, often acting under a G20 mandate. The main international institutions issuing rules that are relevant to banking activity are the Financial Stability Board, the Bank for International Settlements (under which the Basel Committee on Banking Supervision was established and functions), the International Organization of Securities Commissions and the International Accounting Standards Board.

European: At European level, the European Commission, the European Council and the European Parliament - the so-called "co-legislators” - intervene in the legislative and regulatory process. The European supervisory authorities (EBA, ESMA and EIOPA) and the European Systemic Risk Board are also involved in the process.

National: At the national level, the legislators are the Assembly of the Republic and the Government, with the supervisory authorities subsequently issuing notices and regulations and monitoring the application of laws and regulations: Banco de Portugal, Comissão do Mercado de Valores Mobiliários (Securities Market Commission - CMVM) and Autoridade de Seguros e Fundos de Pensões (Insurance and Pension Funds Authority).